I guess, times are a changing. I've decided to develop and test a system idea in real-time here on the blog. My point isn't to build a system for you, the reader. The point is to share my process...how I capture an idea logically. And more importantly how to continually develop and test until a) the idea's acceptance into the trading library or b) the idea's admittance into Heavenly Hills System Cemetery.

So, what's the idea?

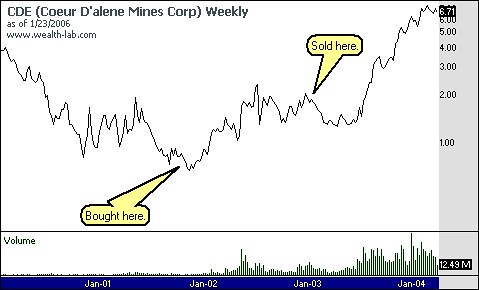

Ever sell a stock out of boredom? When you bought the stock...it looked great. But, after months of underperformance...no better yet...after months of the stock doing nada...you sell. The good news is you didn't really lose money on the investment. But, didn't make any either.

A few weeks or months after closing out your position...the stock breaks to a higher level. Not by a whole lot...still higher than you've ever seen while holding the melba toast. Since the price isn't that much higher than your selling price...you ignore it.

Weeks...months...maybe years go by. Then, like the curiosities of an old flame, the mind wonders...what ever happened to that stock I held back in the day? Pulling up the quote in Yahoo Finance hits you like a Mac truck. That melba toast gained more than 10 times the price you sold it for. Oh, if only I had held it. If only I could stand a little fiber in my diet.

How many of these stocks have you encountered in your trading life? I've experienced plenty. Here are some examples.

About 90% of my equity is allocated to my systems. Around 10% is left as fun money. I can buy stocks for any reason and hold for as long or short as I like with this fun money. The examples above are trades made with this fun money. As you can tell...the trades were horrible. But, this fun money does two very important things for me.

- Allows me to release the self-destructive side of my trading where I can participate a bit with the market masses without destroying my bottom-line.

- By participating in the euphoric buying and panic selling sprees I feel all the things the masses feel. I know what it's like to put 100% of my fun money into one position and get hit like The Equities Research Center's FCL trade. To experience those feelings enable me to observe the patterns and more importantly generate system trading ideas.

And with that we get to the main point. How do we logically capture the stocks that go from nothing to something? The Melba Toasts of the world?

My initial thoughts are to identify areas in the time series where buyers are not rewarded. Basically, no new highs are made within a certain time period...let's say one year or 50 weeks.

What about the downside? I think it's okay for the market to make new lows...but not too much on the downside. So, maybe we can check the max closing low for the past year and compare against the average. How many ATR's is the lowest closing price from the 50 week average? Less than 1 ATR sounds about right.

What else? Hmmm...trend. Yes, we need to check the trend of the stock. We basically need a stock that is not trending upwards. So, trending downwards to a degree...or better yet...no trend at all will provide the maximum frustration for holders of the stock while still keeping them in it.

Let's also add a minimum volume filter of at least a 50 week average daily volume greater than 20,000 shares.

So, what do we have?

- No new highs within the past 50 weeks;

- (50 week average close - 50 week lowest closing price) less than 50 week Average True Range (ATR);

- No uptrend in place;

- At least 20,000 shares traded daily for the past 50 weeks.

- We'll slap a 2 * ATR disaster stop and a 3 * ATR trailing stop from the closing price.

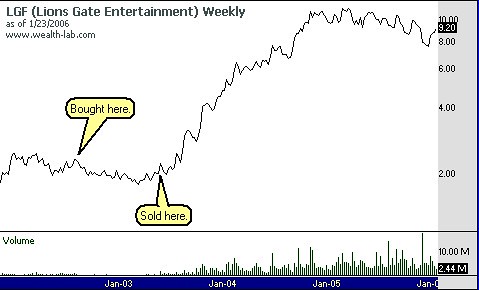

Results? Here's what we've captured on the LGF chart with these rules in place:

Looks good, huh? Well, believe it or not...we've got one heck of a long way to go. LGF is just one stock. Now, the real work begins. And I'll have to leave that for another night. Until then...

Later Trades,

MT

4 comments:

Interesting approach - similar to my approach. Only difference is that I scan for entries off of a gap up. Then use a similar strategy to stay in the stock. I look forward to reading more about your strategy as it develops. Personally, I don't think you're giving away much - the reality is that most people can't/won't follow a system even if they trust it. That was always the argument as to why the Turtle guys gave up their rules - no one could follow them with any discipline.

Interesting indeed. I've never been a fan of systems myself, but I'm willing to be convinced. Tell me more!

About the FCL trade, it's our mandate to be EXTREMELY aggressive. Our goal is to do what Nicolas Darvas did and turn a meager sum into a fortune. Will it work out? I don't know; it's a daunting task that will require nothing but perfection from all involved.

Damian, the gap up pattern is a good one. I also like a true range expansion (usually gaps will occur within this pattern).

The current focus in developing this strategy is filtering down trades. After a bit of time and tests...I'll get to the patterns such as the one you mentioned. Always amazes me how just a little pattern like a gap up or true range expansion can lead to such huge moves in a stock's price.

Stockoperator, I understand where you're coming from in regard to aggressively trading. I trade aggressively myself, many times. No risk...no reward.

But, one thing to watch out for in regard to the 100% allocation. The only way 100% allocation works is with a winning percentage of 100%. Otherwise your optimal profits will be less than a 100% allocation. In other words...there is a point where increasing your position size will not lead to increased profits despite wildly successful trades.

Oh, and you're not the only one who experience a nuclear bomb this week. So, did I in INGR. INGR is from my system trades...I've held it for a long time and have scaled out 3 times now. So, I only have a 1/4 of the position I started with. And I only use 1/20 of Kelly in my position sizing. Despite all that...it still HURTS!!!! :)

Take care,

MT

Reading Stockoperator's comment reminded me of MarketMonk and his "Present Moment Trading Campaign" of 2005 (I'm not trying to imply anything here, it just reminded me, that's all).

Anyone remember MarketMonk and PMTC? I archived his site back then and I see that it, and his supposed follow on site, is no where to be found, now. I have all of his posts from March 21 to April 28, 2005. His first post stated his goal:

"My Present Moment Trading Campaign (PMTC) is an experiment in aggressive trading and compounding. My posts will bear witness to my mission to keep my mind exclusively focused on the "present moment" when trading the S&P 500 index. The goal of this trading campaign is to compound a small trading account into a very larger sum of money in the next 12 months. To reach my goals I will need a constantly volatile market and some luck. But luck has always favored the prepared, and I am very prepared."

Sounds EXTREMELY aggressive to me.

As luck would have it (surprise!), it didn't take him 12 months. In less than a month (by April 22 -- day 23 of the "campaign"), he claims to have turned $5,000 into $8,405,833. That's the last "trade result" post in my archive.

Not too shabby, huh?

I guess he has retired to the proverbial tropical island sipping Mai Tai's or Pina Coladas, because, as I said, he seems to have disappeared shortly after his last post in April. He made some talk about starting a new campaign and letting others trade his riches -- before he disappeared -- and he would only charge a "token" fee of $10,000 for the privilege. What a generous offer! (Although, I'm not sure why he wanted to charge $10,000 -- he only needed $5,000 to get to $8 million in 23 days).

So, anyone know MarketMonk's whereabouts now?

Btw, there's an EliteTrader thread about him:

http://www.elitetrader.com/vb/showthread.php?s=a4025e3ec356d22d4efba9ea49bec733&threadid=51597&perpage=6&pagenumber=1

It seems that many of the commenters in this thread are skeptical. Hmmm, ya think?

Sorry, didn't mean to ramble.

Post a Comment